REPRINTED WITH PERMISSION

December 20, 2023

Commentary: The next chapter for private markets

By Zach Baran

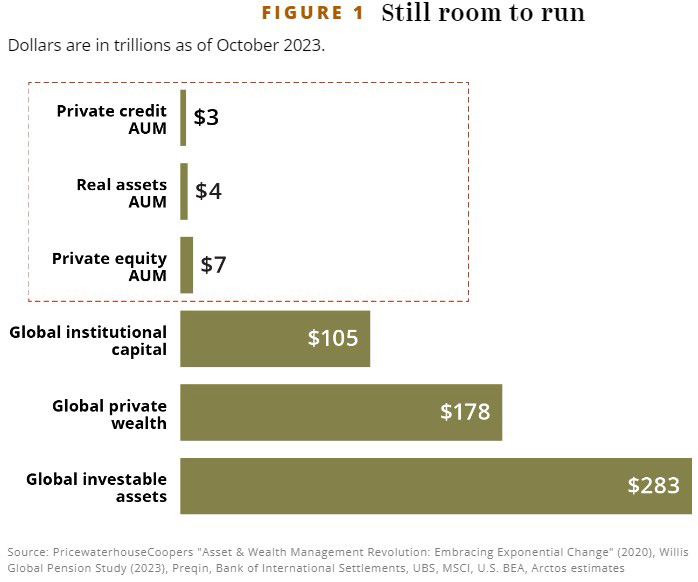

The private markets industry has grown its assets under management by 14x since 2001 and now manages $14 trillion.

We believe the story of private markets is only halfway through and still has plenty of room for growth (Fig. 1).

However, the industry structure that has persisted for decades in private markets is eroding fast. As a result, we believe institutional investors will gravitate to growth-minded general partner sponsors with a playbook for navigating three interrelated challenges:

- The end of fragmentation: New GP formation is getting harder, and scale is increasingly crucial for survival and growth.

- The end of easy money: The multidecade “beta” tailwind that lifted all boats appears to be over.

- The erosion of “20 over 8” or the standard GP compensation model whereby the GP earns 20% of profits after limited partners receive an 8% preferred return: How the industry creates value and generates returns is changing rapidly, requiring new sorts of expertise.

Challenge #1: The end of fragmentation

Private markets is a human-capital heavy professional services industry. These industries can enjoy low barriers to new firm formation because value often “attaches” to people and their relationships, not technologies, systems or brands. We like to say private investing has been more “jazz” than “rock and roll” because a founder’s reputation is what drives their ensemble’s success.

However, as these industries mature, the dynamic shifts. Nowadays, the breadth and quality of Fidelity’s retail client base or Goldman Sachs’ corporate relationships make leaving to start a competing asset manager or bank prohibitively risky. We believe this shift is slowly taking off in private markets. According to our analysis, starting in 2022 and continuing in 2023, the number of active GPs declined for the first time since 2001, with successful new GP launches down nearly 80% from 2021.

While exacerbated by today’s fundraising environment, we believe this trend can be attributed to several long-term factors: manager consolidation among LPs, product expansion among large GPs, implicit price competition via co-investments and separately managed accounts and the growing burden of GP commitments. The net result is higher capital intensity, higher barriers to entry, and corporate brands winning out over individual dealmakers — more rock, less jazz.

Challenge #2: The end of easy money

The average marginal dollar investing in private markets over the last 30 years has likely come from a public pension plan facing the challenge of declining long-term interest rates amid fixed future liabilities. As the public portfolio steadily inflated in value, private markets allocations have been, with few exceptions, routinely behind the curve — an accommodating denominator effect.

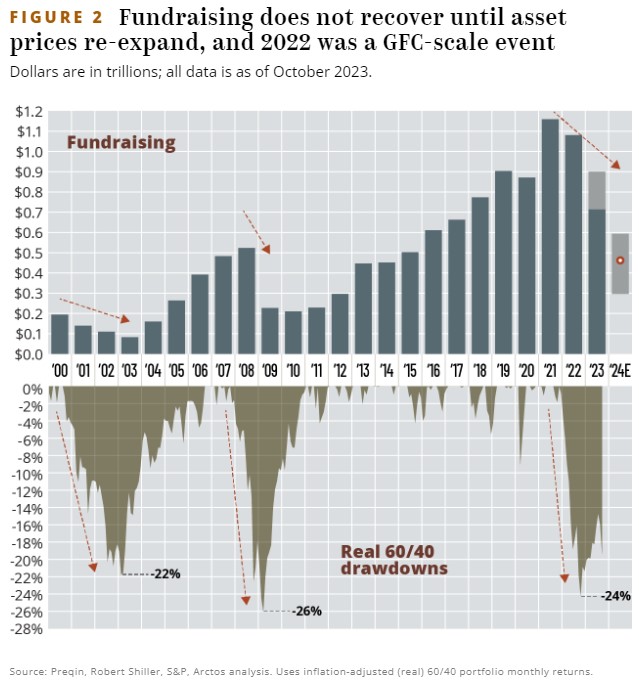

This positive impulse from declining rates is likely over. The industry is facing allocation headwinds caused by a sharp decline in risk assets and (more impactful this time around vs. 2008) a major write-up in NAV. The result? A punitive denominator effect. Declines in fundraising can be tracked and forecasted using performance of the inflation-adjusted 60/40 total return index (Fig. 2). This index declined 24% in 2022 — as much as it did during the last two recessions.

The math behind this overallocation problem suggests a three-year correction period at best, likely longer. The slowdown in fundraising creates significant challenges for GPs, made worse by continued pressure from elevated real interest rates, higher and more volatile inflation, and a chaotic geopolitical environment.

Challenge #3: The erosion of “20 over 8”

The largest GPs are no longer just renting LPs’ capital at the 8% preferred return; they now own permanent capital directly, through avenues like insurance affiliates.

Insurance companies often have the retail distribution capabilities needed to sell their solutions, making insurance affiliation an elegant way for GPs to buy retail capabilities. Whether it’s bought or built, retail distribution will be increasingly necessary for growth in private markets.

While retail distribution creates opportunity, it also comes with product-market fit and marketing problems. In many cases, it challenges the existing core strengths of GPs. It is also expensive, requiring resources at scale and a strong balance sheet. GP sponsors have transitioned from pure private equity business models into the “financial supermarkets” more commonly seen in traditional asset management and investment banking. In our view, an inevitable marriage is forming between traditional financial services capabilities, products and capital structures with alternative assets.

How can GP sponsors continue to thrive?

We believe alpha-focused sponsors, and their LPs, can ultimately win in this environment. However, it will require both capital and new capabilities:

- There will be more intense competition for talent and capital due to the need for new skill sets and a challenging fundraising environment. The private markets are not conditioned to support as many winners as it has in the past. Sensible growth can provide more ways to compete, differentiate, service LPs and retain talent.

- There will be growing demands on GPs’ capital and time. These include rising GP commitments against a slowdown in carry distributions, as well as the need to build up their business via investments in both traditional and non-traditional distribution capabilities.

- We believe the end is nigh for absolute performance as a talent benchmark. In the post-easy money era, GPs that can identify which talents are true alpha generators or add differentiation to their performance story should have an advantage when engaging with LPs. And LPs will have a similar advantage using these tools to select managers.

In short, this new chapter for private markets creates several factors that LPs must account for and GPs must accommodate. Solving these challenges will require collaboration and creativity among all parties, including those in the business of providing capital to both GPs and LPs. In our view, the need for alignment and thought partnership represents a kind of fourth challenge because many existing solution “archetypes” introduce misalignment and create long-term problems for sponsors and their funds. For example, GP stake sales can complicate ownership and governance transition, and continuation funds, as they are designed today, can break alignment between GPs and their LPs. NAV loans may be the worst of the trio, since they force LPs to borrow at rates well above their cost of debt to manufacture higher interim returns or more dry powder. The sponsors that can effectively navigate this market and find thought partners of scale will be well positioned to create positive-sum partnerships with their investors.

Zach Baran is a director at Arctos Partners. He is based in New York. This content represents the views of the author. It was submitted and edited under Pensions & Investments guidelines but is not a product of P&I’s editorial team.

This content appeared on pionline.com and represents the views of the author. It was submitted and edited under P&I guidelines, but is not a product of P&I’s editorial team. Crain Communications 732.723.0569. DO NOT EDIT OR ALTER REPRINTS. REPRODUCTIONS ARE NOT PERMITTED. #24001

© Entire Contents copyright by Crain Communications Inc. All rights reserved.